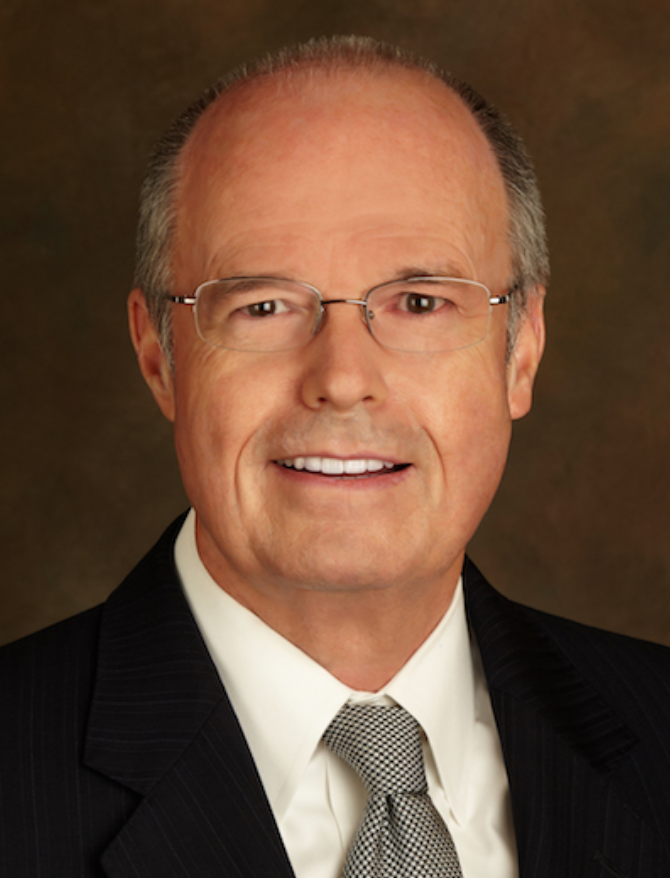

Richard Bowen

As a business chief underwriter for Citigroup during the housing bubble and subsequent financial crisis, Richard Bowen repeatedly cautioned executive management and the board of directors that roughly 60 percent of prime mortgages were defective. He also warned about risks associated with Citigroup’s practice of lowering its standards for subprime mortgage pools. His warnings were ignored, and Citigroup eventually stripped him of all responsibilities, placed him on administrative leave, and told him his presence was no longer required at the bank. Bowen sought the help of Government Accountability Project and later testified before the Securities and Exchange Commission, providing 1,000 pages of evidence of fraudulent activities, with the bank bailouts occurring three months later. In 2010, Bowen was a key witness about the mortgage mishaps as he gave nationally televised testimony before the Financial Crisis Inquiry Commission. His story was covered by 60 Minutes, The Wall Street Journal, and The New York Times, and other news outlets.